Electric Bicycles, commonly referred to as “e-bikes”, are all the rage! According to recent reports, the sales of e-bikes are expected to surge over the next 3 years with estimates that over 130 million will be sold! Employees of our agency have owned and ridden them, and they are a blast!

“I just purchased a new Electric Bike and dropped $2,500, will my home/renters or auto policy cover it?”

We get this question often, and I would be willing to bet as often as we are asked, there are probably 10x the amount of owners who never think to do so! Generally speaking, there is NO COVERAGE AT ALL! No liability coverage if you run into someone and cause them an injury, or cause someone else property damage (oops, did I just slam into your Dodge Stratus?!) and no physical damage coverage (e-bikes are a HUGE target for theft).

“Why doesn’t my insurance cover it like the rest of my property?”

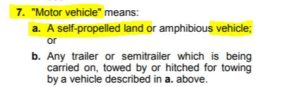

Insurance policies are contracts, and the fine print is what you need to read to understand where the issue lies. Almost all standard homeowners, renters, condo policies have an exclusion in the contents coverage that will exclude any and all coverage for “motor vehicles” which the policy will usually define as something like this:

The purpose of this exclusion is that your cars, pick-up trucks, ATVs should all be insured on a separate policy. However, electric bicycles also qualify under this definition. This means your personal property coverage will not apply! So that awesome $3,500 e-bike you just picked up has no coverage! Better invest in a highly ranked bike lock, or transfer the risk by buying a e-bike policy!

“I am not worried if someone steals my bike; but what if I hit someone and they get hurt?”

Bad news – standard insurance policies will also exclude injury or property damage on homeowners, renters or condo policy for loss arising out of the use of a “motor vehicle” as defined above.

“So can I just add my e-bike to my auto policy?”

Unfortunately every insurance company we currently work with does not allow you to add an e-bike to a personal auto policy.

“What do I do?”

Simple – purchase an e-bike policy! There are a handful of companies out there that let you buy a policy simliar to a motorcycle policy. You can purchase liability coverage, un-insured and under-insure motorist coverage, medical payments and physical damage coverages. Physical damage coverages like comprehensive (other-than-collision) will pay for loss caused by theft, vandalism, falling objects, hitting a deer (Sorry Bambi!). You can also purchase collision if the e-bike gets damaged by colliding with another biker, car or anything else!

If you want to have coverage, and stay protected, request a quote today!